Find

Search for over 200,000 study notes and past assignments!

Swap

Download study resources by swapping your own or buying Exchange Credits.

Study

Study from your library anywhere, anytime.

22207 Accounting for Business Decision Notes

22207 - Accounting for Business Decisions B

53 Pages • Complete Study Notes • Year: Pre-2021

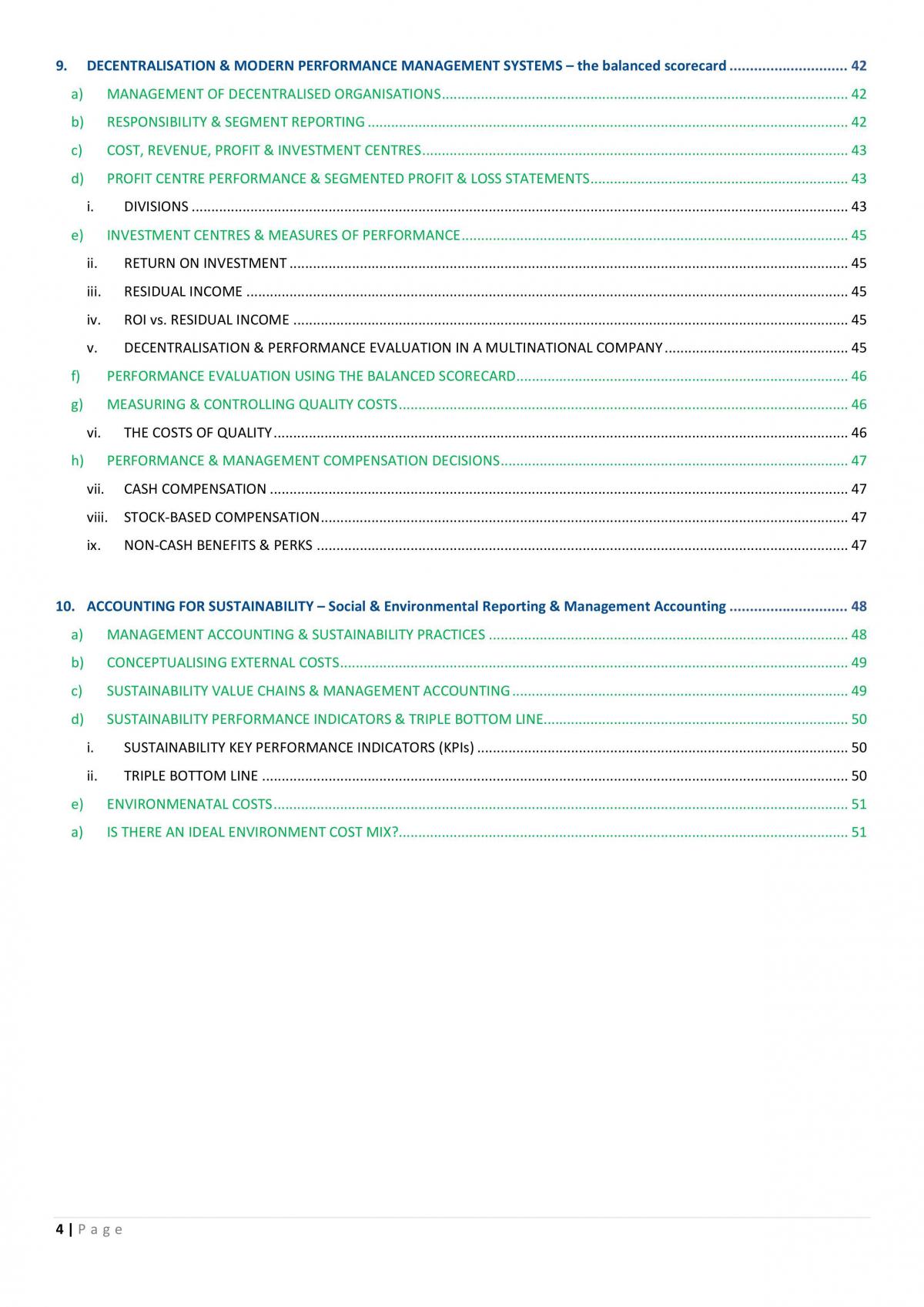

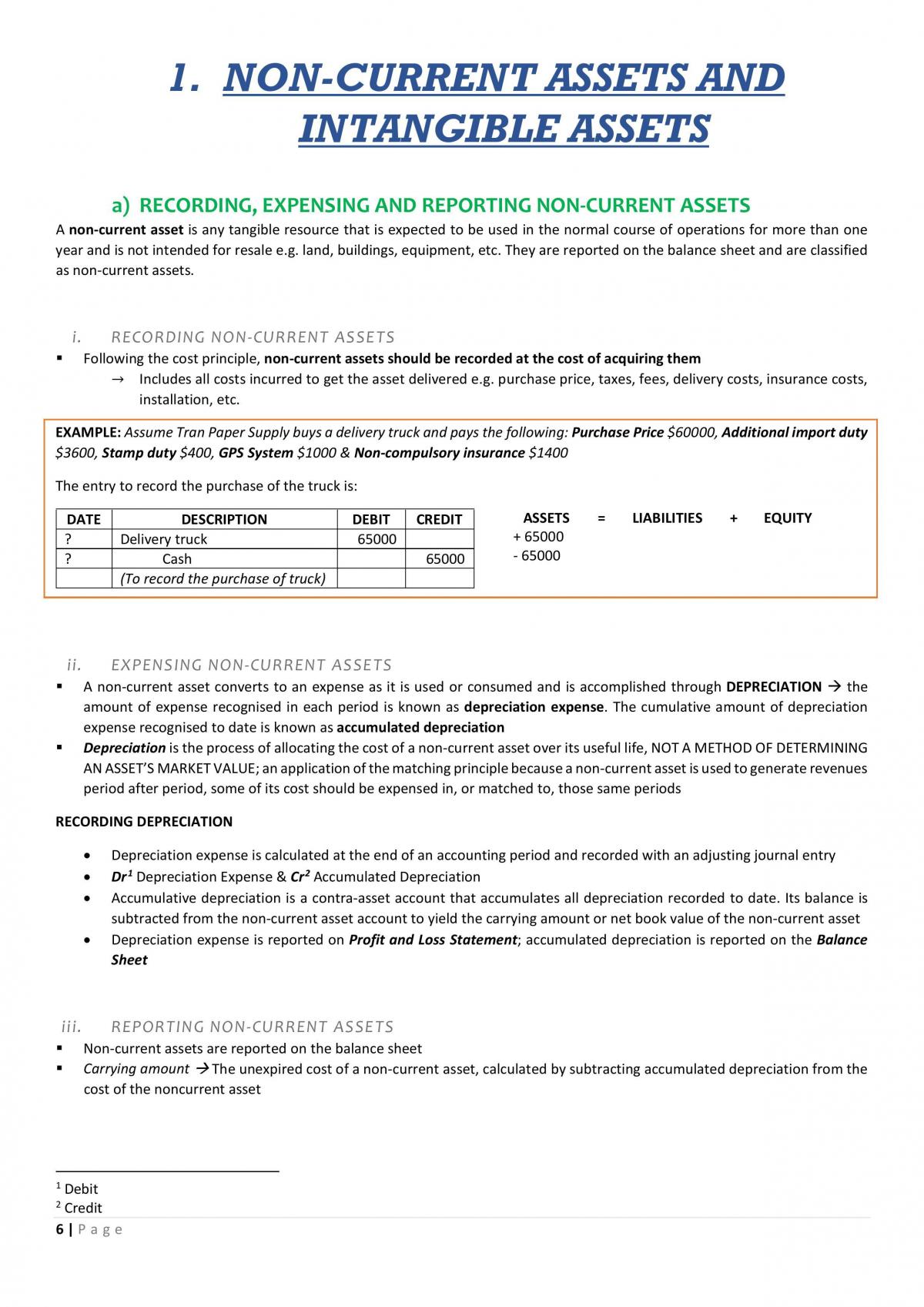

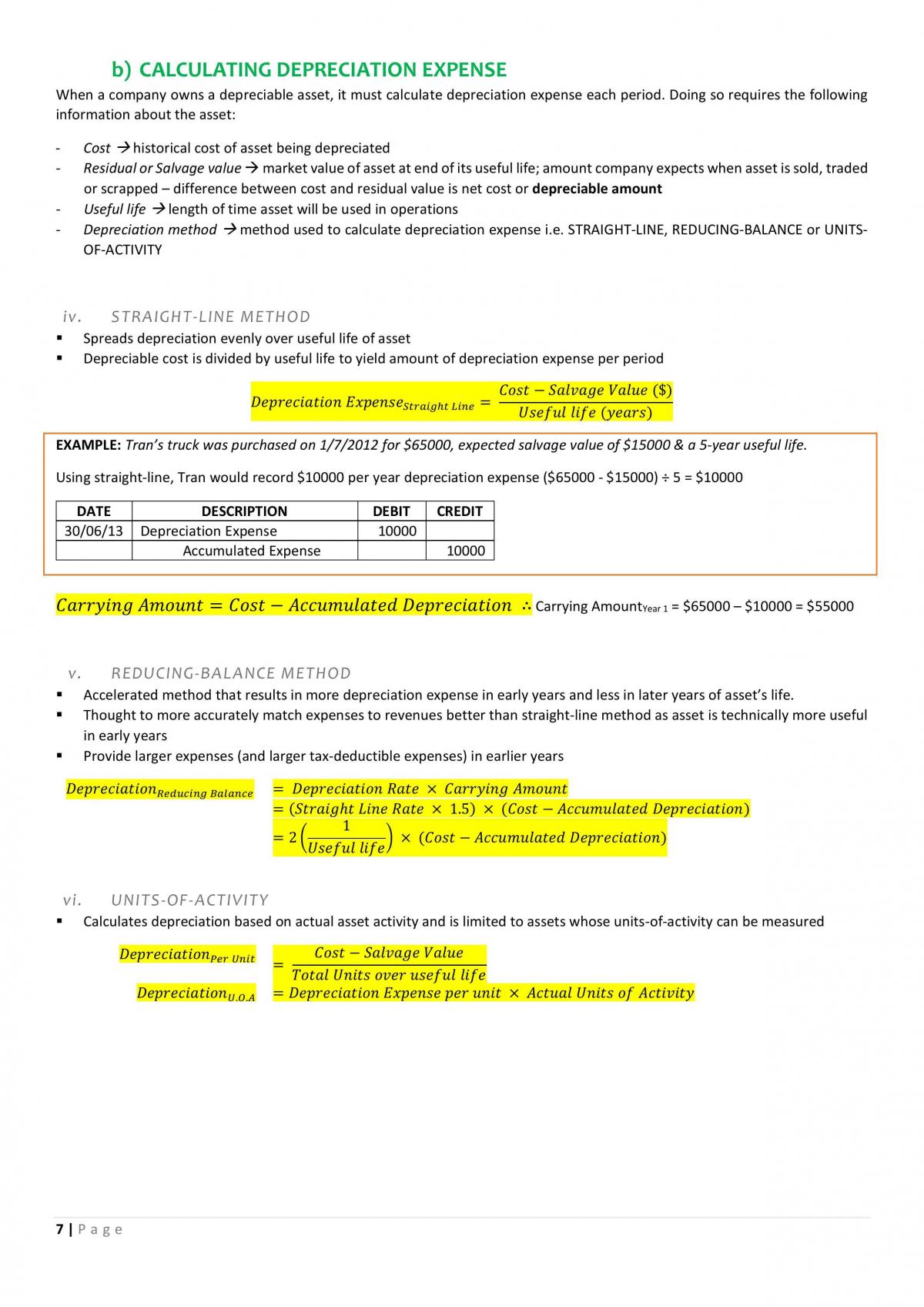

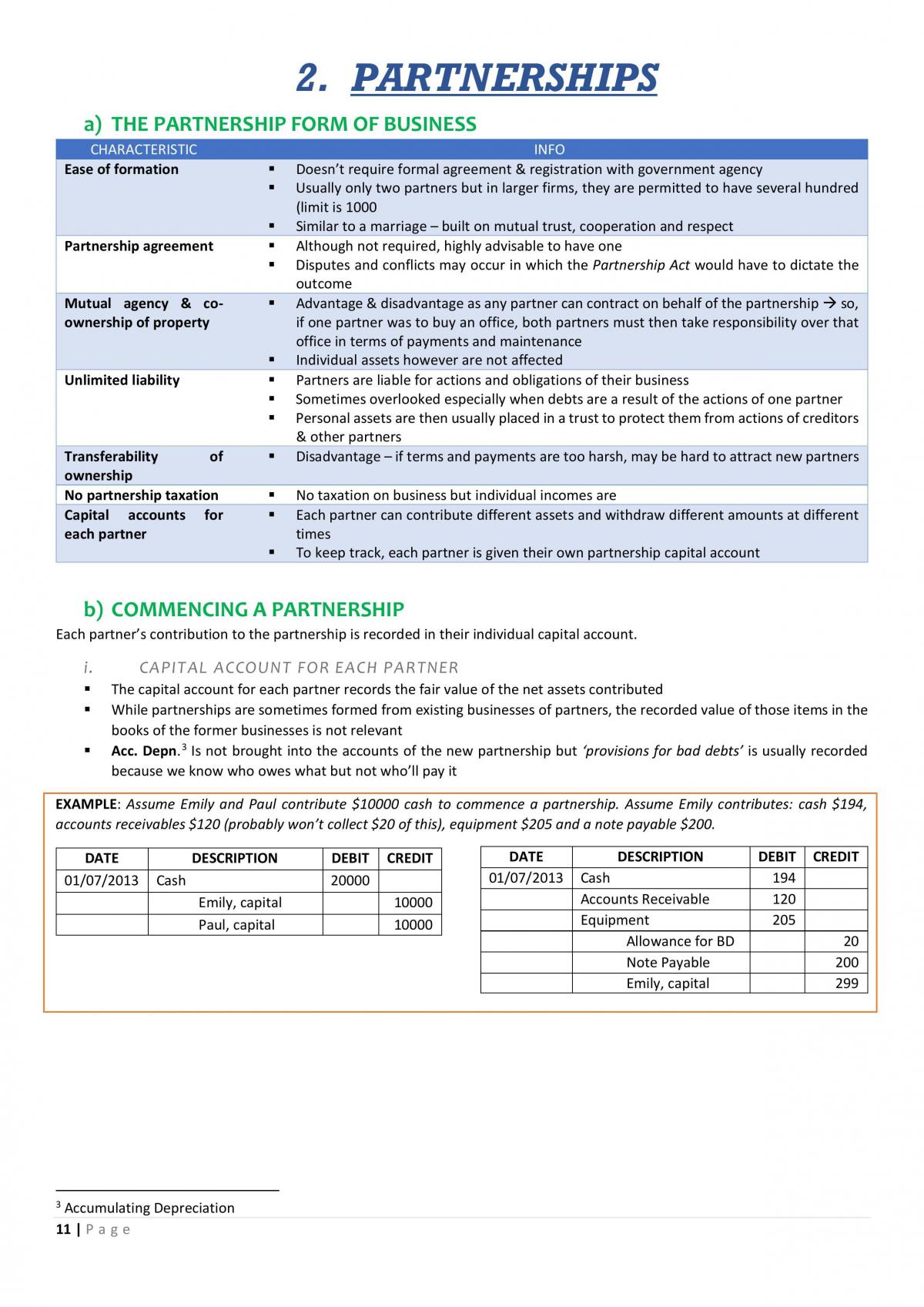

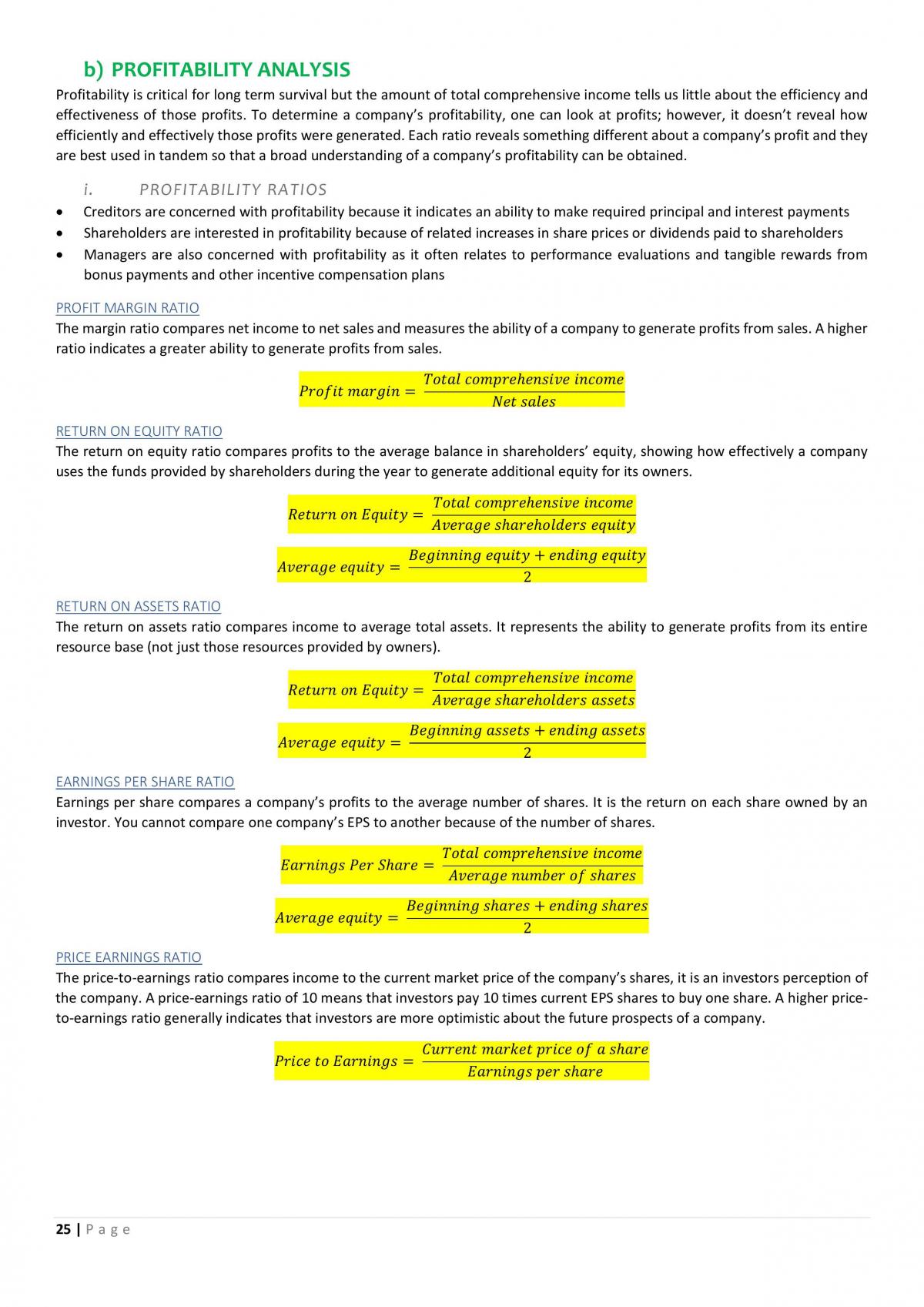

Contents FINANCIAL 1. NON-CURRENT ASSETS AND INTANGIBLE ASSETS ............................................................................................................... 6 a) RECORDING, EXPENSING AND REPORTING NON-CURRENT ASSETS...................................................................................... 6 i. RECORDING NON-CURRENT ASSETS ................................................................................................................................. 6 ii. EXPENSING NON-CURRENT ASSETS................................................................................................................................... 6 iii. REPORTING NON-CURRENT ASSETS .................................................................................................................................. 6 b) CALCULATING DEPRECIATION EXPENSE ................................................................................................................................ 7 iv. STRAIGHT-LINE METHOD ................................................................................................................................................... 7 v. REDUCING-BALANCE METHOD .......................................................................................................................................... 7 vi. UNITS-OF-ACTIVITY ............................................................................................................................................................ 7 c) ADJUSTMENTS MADE DURING A NON-CURRENT ASSET’S USEFUL LIFE................................................................................ 8 vii. CHANGES IN DEPRECIATION ESTIMATES ........................................................................................................................... 8 viii. EXPENDITURES AFTER ACQUISITION ................................................................................................................................. 8 ix. ASSET IMPAIRMENTS......................................................................................................................................................... 9 x. ASSET REVALUATIONS ....................................................................................................................................................... 9 d) DISPOSING OF NON-CURRENT ASSETS .................................................................................................................................. 9 xi. RULE FOR CALCULATING THE GAIN OR LOSS ON DISPOSAL .............................................................................................. 9 e) INTANGIBLE ASSETS ............................................................................................................................................................. 10 xii. RECORDING INTANGIBLE ASSETS .................................................................................................................................... 10 xiii. AMORTISING INTANGIBLE ASSETS................................................................................................................................... 10 2. PARTNERSHIPS.................................................................................................................................................................. 11 a) THE PARTNERSHIP FORM OF BUSINESS ............................................................................................................................... 11 b) COMMENCING A PARTNERSHIP .......................................................................................................................................... 11 i. CAPITAL ACCOUNT FOR EACH PARTNER ......................................................................................................................... 11 c) ALLOCATE PROFITS & LOSSES .............................................................................................................................................. 12 ii. SHARING PROFITS BASED ON A SET PERCENTAGE .......................................................................................................... 12 iii. SHARING PROFITS BASED ON CAPITAL BALANCES & ON SERVICES ................................................................................ 12 d) ADMISSION & WITHDRAWAL OF PARTNER ......................................................................................................................... 13 iv. PURCHASING A CURRENT PARTNER’S INTEREST ............................................................................................................. 13 v. INVESTING IN THE PARTNERSHIP .................................................................................................................................... 13 vi. INVESTING IN THE PARTNERSHIP: Bonus to the NEW partners ...................................................................................... 13 vii. INVESTING IN THE PARTNERSHIP: Bonus to EXISTING partners ..................................................................................... 14 viii. WITHDRAWAL OF A PARTNER ........................................................................................................................................ 14 ix. REVALUATION OF ASSETS BEFORE A WITHDRAWAL OF A PARTNER .............................................................................. 14 x. WITHDRAWAL OF A PARTNER AT CARRYING AMOUNT .................................................................................................. 15 xi. WITHDRAWAL OF A PARTNER AT MORE THAN THE CARRYING AMOUNT ..................................................................... 15 xii. WITHDRAWAL OF A PARTNER AT LESS THAN CARRYING AMOUNT ................................................................................ 15 2 | P a g e e) LIQUIDATION ....................................................................................................................................................................... 15 xiii. SALE OF ASSETS ............................................................................................................................................................... 15 xiv. PAYING LIABILITIES .......................................................................................................................................................... 16 xv. PARTNERS RECEIVE REMAINING CASH ............................................................................................................................ 16 3. SHAREHOLDERS’ EQUITY................................................................................................................................................... 17 a) THE CORPORATE FORM OF BUSINESS ................................................................................................................................. 17 b) ORDINARY SHARES ............................................................................................................................................................... 17 i. SHAREHOLDER RIGHTS .................................................................................................................................................... 17 ii. RECORDING ORDINARY SHARES ...................................................................................................................................... 18 iii. ISSUING SHARES BY INSTALMENT ................................................................................................................................... 18 c) DIVIDENDS ........................................................................................................................................................................... 19 iv. CASH DIVIDENDS ............................................................................................................................................................. 19 v. SHARE DIVIDENDS ........................................................................................................................................................... 19 vi. SHARE SPLITS ................................................................................................................................................................... 19 d) PREFERENCE SHARES ........................................................................................................................................................... 20 vii. CASH DIVIDENDS ON PREFERENCE SHARES .................................................................................................................... 20 e) SHARE BUYBACKS ................................................................................................................................................................ 20 4. STATEMENT OF CASH FLOWS ............................................................................................................................................ 21 a) THE STATEMENT OF CASH FLOWS ....................................................................................................................................... 21 b) PREPARING THE STATEMENT OF CASH FLOWS ................................................................................................................... 21 i. DIRECT OR INDIRECT METHODS OF OPERATING CASH FLOWS ....................................................................................... 21 c) Reporting Cash Flows from Operating Activities: DIRECT METHOD .................................................................................... 22 ii. OTHER REVENUES & EXPENSES ....................................................................................................................................... 22 d) Reporting Cash Flows from Operating Activities: INDIRECT METHOD ................................................................................ 23 e) CALCULATING CASH FLOWS FROM INVESTING ACTIVITIES ................................................................................................. 23 iii. INVESTING INFLOWS & OUTFLOWS OF CASH ................................................................................................................. 23 f) CALCULATING CASH FLOWS FROM FINANCING ACTIVITIES ................................................................................................ 23 iv. FINANCING INFLOWS & OUTFLOWS OF CASH ................................................................................................................ 23 5. FINANCIAL STATEMENT ANALYSIS .................................................................................................................................... 24 a) HORIZONTAL & VERTICAL ANALYSIS .................................................................................................................................... 24 b) PROFITABILITY ANALYSIS ..................................................................................................................................................... 25 i. PROFITABILITY RATIOS .................................................................................................................................................... 25 c) LIQUIDITY ANALYSIS ............................................................................................................................................................. 26 ii. SOLVENCY RATIOS ........................................................................................................................................................... 26 d) SOLVENCY ANALYSIS ............................................................................................................................................................ 27 iii. SOLVENCY RATIOS ........................................................................................................................................................... 27 e) DuPont ANALYSIS ................................................................................................................................................................. 27 3 | P a g e MANAGERIAL 6. ETHICS .............................................................................................................................................................................. 29 7. FIXED & ROLLING BUDGETS FOR PLANNING & DECISION MAKING ................................................................................... 30 a) THE BUDGET DEVELOPMENT PROCESS ............................................................................................................................... 30 i. PARTICIPATION IN THE BUDGET DEVELOPMENT PROCESS............................................................................................. 30 ii. BEHAVIOURAL IMPLICATIONS OF BUDGETING ............................................................................................................... 30 iii. ADVANTAGES OF BUDGETING ......................................................................................................................................... 30 iv. THE MASTER BUDGET ...................................................................................................................................................... 30 b) PRODUCTION BUDGET ......................................................................................................................................................... 31 c) MATERIAL, LABOUR, OVERHEAD & SELLING and ADMINISTRATIVE EXPENSE BUDGETS .................................................... 31 v. MATERIAL PURCHASES BUDGET ...................................................................................................................................... 31 vi. DIRECT LABOUR BUDGET ................................................................................................................................................ 32 vii. MANUFACTURING OVERHEAD BUDGET .......................................................................................................................... 32 viii. SELLING & ADMINISTRATIVE EXPENSE BUDGET ......................................................................................................... 33 d) CASH BUDGETS .................................................................................................................................................................... 33 ix. CASH RECEIPT BUDGETS .................................................................................................................................................. 33 x. CASH DISBURSEMENTS BUDGET ..................................................................................................................................... 33 xi. SUMMARY CASH BUDGET ............................................................................................................................................... 34 e) STATIC vs. FLEXIBLE BUDGETS ............................................................................................................................................. 35 f) PREPARING A FLEXIBLE BUDGET .......................................................................................................................................... 35 xii. WHAT IS A FLEXIBLE BUDGET? ........................................................................................................................................ 35 xiii. WHY FLEXIBLE BUDGETS? ................................................................................................................................................ 35 xiv. FLEXIBLE BUDGETING WITH STANDARD COSTS ............................................................................................................... 36 8. MANAGEMENT ACCOUNTING FOR COST CONTROL & PERFORMANCE EVALUATION – Flexible Budgets & Variance Analysis 38 a) FLEXIBLE BUDGET VARIANCE ............................................................................................................................................... 38 i. SALES PRICE VARIANCE.................................................................................................................................................... 38 ii. SELLING & ADMINISTRATIVE EXPENSE VARIANCE .......................................................................................................... 38 b) VARIABLE MANUFACTURING COST VARIANCES .................................................................................................................. 39 iii. THE VARIANCE ANALYSIS MODEL .................................................................................................................................... 39 c) DIRECT MATERIAL VARIANCES ............................................................................................................................................. 40 iv. DIRECT MATERIAL PRICE VARIANCE ................................................................................................................................ 40 v. DIRECT MATIERAL USAGE VARIANCE .............................................................................................................................. 40 vi. DIRECT MATERIAL VARIANCES WHEN AMOUNT PURCHASED DIFFERS FROM AMOUNT USED ..................................... 40 d) DIRECT LABOUR VARIANCES ................................................................................................................................................ 40 e) INTERPRETING AND USING VARIANCE ANALYSIS ................................................................................................................ 41 vii. MANAGEMENT BY EXCEPTION ........................................................................................................................................ 41 viii. INTERPRETING FAVOURABLE & UNFAVOURABLE VARIANCES ........................................................................................ 41 4 | P a g e 9. DECENTRALISATION & MODERN PERFORMANCE MANAGEMENT SYSTEMS – the balanced scorecard ............................. 42 a) MANAGEMENT OF DECENTRALISED ORGANISATIONS ........................................................................................................ 42 b) RESPONSIBILITY & SEGMENT REPORTING ........................................................................................................................... 42 c) COST, REVENUE, PROFIT & INVESTMENT CENTRES ............................................................................................................. 43 d) PROFIT CENTRE PERFORMANCE & SEGMENTED PROFIT & LOSS STATEMENTS .................................................................. 43 i. DIVISIONS ........................................................................................................................................................................ 43 e) INVESTMENT CENTRES & MEASURES OF PERFORMANCE ................................................................................................... 45 ii. RETURN ON INVESTMENT ............................................................................................................................................... 45 iii. RESIDUAL INCOME .......................................................................................................................................................... 45 iv. ROI vs. RESIDUAL INCOME .............................................................................................................................................. 45 v. DECENTRALISATION & PERFORMANCE EVALUATION IN A MULTINATIONAL COMPANY ............................................... 45 f) PERFORMANCE EVALUATION USING THE BALANCED SCORECARD ..................................................................................... 46 g) MEASURING & CONTROLLING QUALITY COSTS ................................................................................................................... 46 vi. THE COSTS OF QUALITY ................................................................................................................................................... 46 h) PERFORMANCE & MANAGEMENT COMPENSATION DECISIONS ......................................................................................... 47 vii. CASH COMPENSATION .................................................................................................................................................... 47 viii. STOCK-BASED COMPENSATION ....................................................................................................................................... 47 ix. NON-CASH BENEFITS & PERKS ........................................................................................................................................ 47 10. ACCOUNTING FOR SUSTAINABILITY – Social & Environmental Reporting & Management Accounting ............................. 48 a) MANAGEMENT ACCOUNTING & SUSTAINABILITY PRACTICES ............................................................................................ 48 b) CONCEPTUALISING EXTERNAL COSTS .................................................................................................................................. 49 c) SUSTAINABILITY VALUE CHAINS & MANAGEMENT ACCOUNTING ...................................................................................... 49 d) SUSTAINABILITY PERFORMANCE INDICATORS & TRIPLE BOTTOM LINE.............................................................................. 50 i. SUSTAINABILITY KEY PERFORMANCE INDICATORS (KPIs) ............................................................................................... 50 ii. TRIPLE BOTTOM LINE ...................................................................................................................................................... 50 e) ENVIRONMENATAL COSTS ................................................................................................................................................... 51 a) IS THERE AN IDEAL ENVIRONMENT COST MIX? ...................................................................................................................

This document is 25 Exchange Credits

More about this document:

|

|

This document has been hand checkedEvery document on Thinkswap has been carefully hand checked to make sure it's correctly described and categorised. No more browsing through piles of irrelevant study resources. |

|

|

This is a Complete Set of Study NotesComplete Study Notes typically cover at least half a semester’s content or several topics in greater depth. They are typically greater than 20 pages in length and go into more detail when covering topics. |

|

|

What are Exchange Credits?Exchange Credits represent the worth of each document on Thinkswap. In exchange for uploading documents you will receive Exchange Credits. These credits can then be used to download other documents for free. |

|

|

Satisfaction GuaranteeWe want you to be satisfied with your learning, that’s why all documents on Thinkswap are covered by our Satisfaction Guarantee. If a document is not of an acceptable quality or the document was incorrectly described or categorised, we will provide a full refund of Exchange Credits so that you can get another document. For more information please read Thinkswap's Satisfaction Guarantee. |

Studying with Academic Integrity

Studying from past student work is an amazing way to learn and research, however you must always act with academic integrity.

This document is the prior work of another student. Thinkswap has partnered with Turnitin to ensure students cannot copy directly from our resources. Understand how to responsibly use this work by visiting ‘Using Thinkswap resources correctly’.

Browse UTS Subjects